When the CHIPS and Science Act passed in 2022 with bipartisan fanfare, many in our industry breathed a sigh of relief. A 52.7 billion dollar lifeline to revive domestic semiconductor production – a sector that had plummeted from 40% of global output in 1990 to just 12% now – seemed like a game changer. Three years later, the optimism feels like it was misplaced.

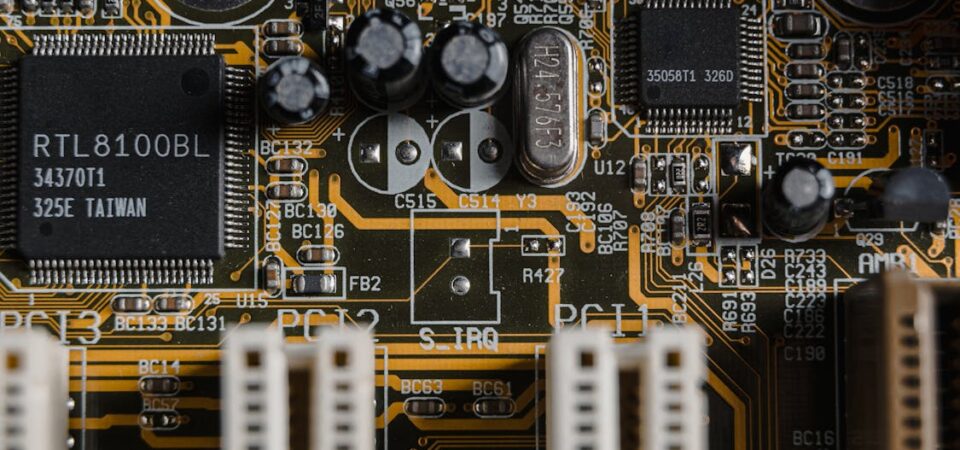

From where we stand at AFI, a Massachusetts-based ENIG plating specialist for mission-critical PCBs and machine parts, the CHIPS Act has become a case study in half-measures. It’s like building a race car, but forgetting the transmission.

The Promise vs. The Paperwork

Let’s start with some of the numbers:

- 2 billion dollars reserved for semiconductors used in defense systems

- 0 dollars allocated for supporting industries like PCB finishing

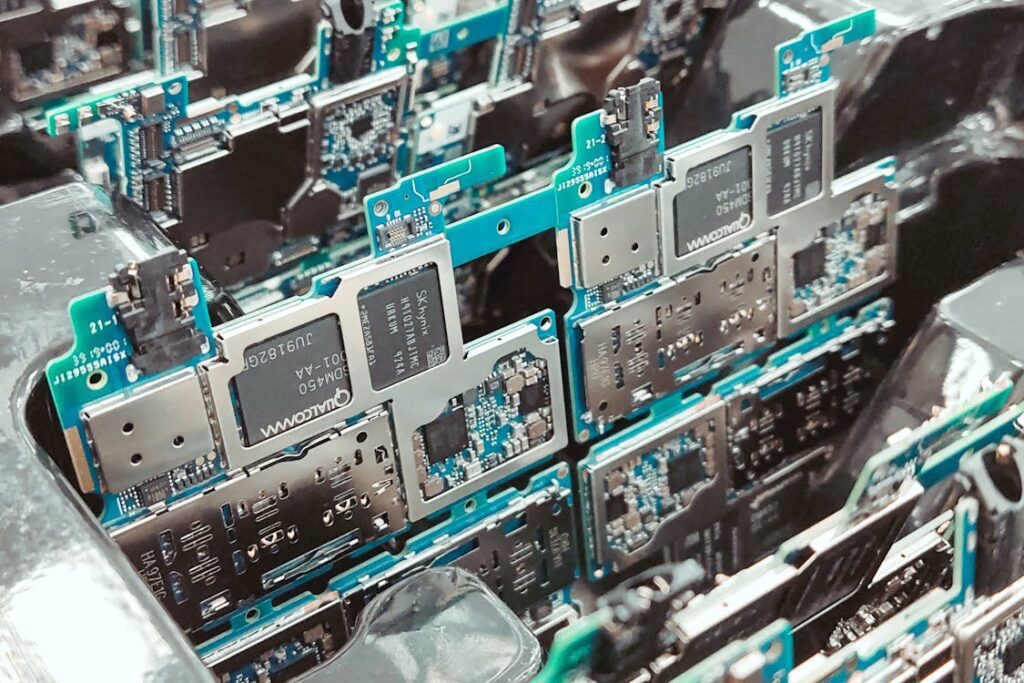

“The CHIPS Act treats semiconductors as a kind of island,” says Robert Peterson, President of AFI. “But chips don’t exist in a vacuum. Without robust support for PCB manufacturing and advanced finishes like electroless nickel immersion gold, billion dollar fabs can only produce components that can’t interface with real-world systems.”

Geographical restrictions are another part of the story. While the CHIPS Act bars funding recipients from expanding in China, it does little to address the existing offshore dominance of PCB production. Over 75% of global PCB manufacturing is based in Asia – and this is virtually unchanged since 2022.

Where the CHIPS Act Failed

The Narrow Focus on Front-End Manufacturing: Building fabs is just one step in a multifaceted process. Semiconductors require:

- High-reliability PCBs (like those we plate at AFI)

- Precision connectors

- Advanced packaging

The CHIPS Act’s subsidies ultimately ignore such critical components. The result? A U.S.-made chip still needs to travel overseas for integration into many functional assemblies. This is a critical vulnerability that the CHIPS Act purported to fix!

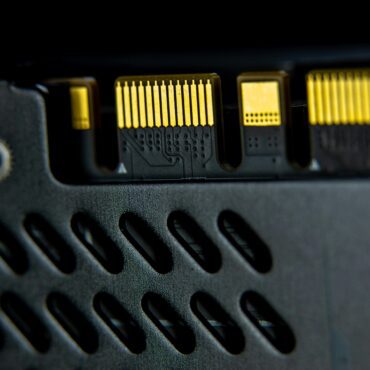

Legacy Tech Problems: Finishing Infrastructure

While the Act’s 2 billion dollars allocated for mature semiconductors was a great move, the execution has some critical blind spots when it comes to legacy tech. Legacy chips, used in automotive and defense systems, often require finishes that can withstand a huge range in thermal cycling. Yet, almost none of the funding from the CHIPS Act supports the kind of finishing infrastructure necessary to make this possible domestically.

Remaining Supply Chain Risks

Consider this hypothetical scenario for supply a defense contractor:

- Client: A defense contractor needing 500 ENIG-plated boards

- Challenge: Four week lead time due to overseas substrate sourcing

- Result: Delayed defense system rollout that compromises national security

These kinds of issues aren’t rare, they’re all too routine. Despite the CHIPS Act’s ambitions, 78% of PCB substrates are still imported! Clients sometimes ask for plated components after they’ve already been shipped to Asia and back. Advocates of the CHIPS Act seem to have forgotten that supply chain resilience isn’t just about the location chips are made – it’s about where you make everything else too!

Trade Short-Sightedness

Another overarching issue with the CHIPS Act is that it presumed things would stay more or less the same when it comes to international supply chains and trade. The recent turmoil regarding trade policy and geopolitical frictions have shredded that presumption. Essentially, domestic manufacturers have even less time to reorganize supply chains and fill potential market voids – which means a more aggressive approach must be taken if we don’t want to fall behind or exacerbate already notable national security and supply-chain related threats!

A Potential Path Forward

To salvage the CHIPS Act’s intent, we propose:

- Expanding subsidies to support critical infrastructure as well as industries like PCB fabrication and finishing to help faster pivot towards domestic production

- Create tax incentives for companies to use domestic component suppliers to side-step supply chain vulnerabilities and fuel growth of our domestic industries

- Fund regional tech hubs that specialize in back-end processes such as plating, testing and packaging.

Such a more holistic approach would level the playing field against subsidized overseas competitors and most importantly, allow American manufacturers to do what we do best – innovate.

The Bottom Line

The CHIPS Act aims to rebuild American tech sovereignty, however, it’s become a lesson in unintended consequences and shortsightedness. Until policymakers recognize that semiconductors are just one link in these critical supply chains, our industry will keep facing the same bottlenecks.

At AFI, we’ll continue delivering top-of-the-line plating services from anything from medical implants to missile systems. But imagine what we could do with a policy that matches our commitment.

Robert Peterson is President of Alternate Finishing, an AS9100D, ISO 9001:2015, and ITAR registered metal finishing provider serving customers across the USA and Canada. With more than four decades of experience in printed circuit boards and metal finishing, Robert is certified by the National Association of Metal Finishers as an electronic specialist. He’s also an avid photographer.